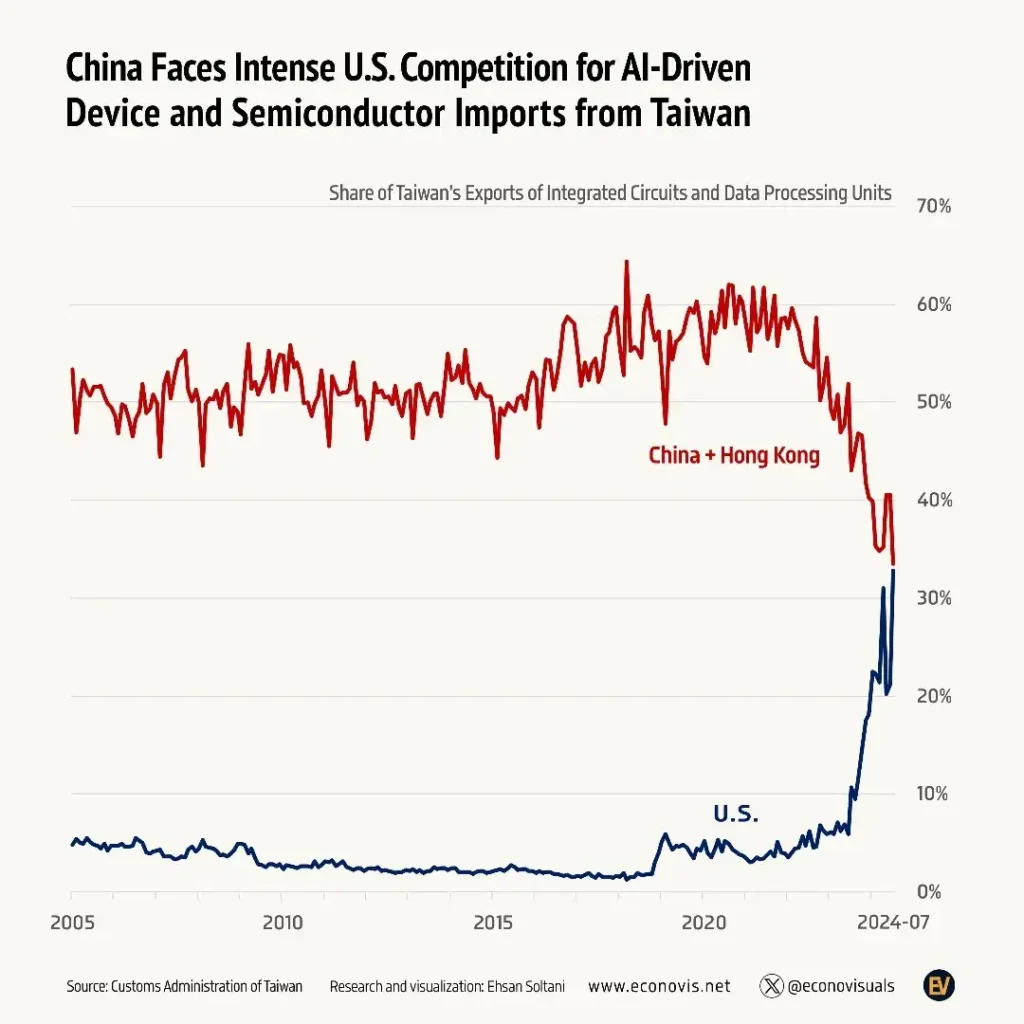

Taiwan, a major player in the global tech supply chain, recently reported a sharp decline in AI-related exports, especially to the United States.

This downturn, the largest since 2015, has significant implications for investors, tech enthusiasts, and the broader economy. Let’s analyze the impact of this decline, explore the factors behind it, and discuss what it means for the future of AI as a growth driver.

Taiwan’s AI Export Data

Taiwan’s AI exports fell by 18.6% month-over-month, with shipments to the U.S. dropping 23.8%. This highlights the challenges facing Taiwan’s AI sector, as local media present an optimistic outlook that doesn’t align with official data from the Taiwanese Trade Ministry.

The mismatch between these perspectives underscores the need for a clear understanding of the current economic environment.

Other sectors also saw mixed results. In August, export orders for telecommunications products grew by 16%, and electronic product orders climbed by 13.2%. However, these gains didn’t carry into September, with export growth slowing to 4.5% YoY.

Despite these challenges, exports to the U.S. showed 27.3% YoY growth in September, though this was much lower than the 70%+ YoY increases seen in previous months. Meanwhile, exports to South Korea grew 35% YoY, while exports to China, Japan, and Europe dragged down overall growth.

The Fragility of AI as a Growth Engine

AI has often been seen as a major economic driver, but the current data reveals its vulnerabilities. Demand for AI servers appears to be plateauing, with only a few large companies dominating a saturated market. This poses risks for economies relying heavily on AI, as fluctuations in demand can directly impact GDP, employment rates, and overall economic stability.

Semiconductors, critical for AI technology, recovered 5.2% YoY in September, ending a two-month contraction. Despite this, growth in computer exports slowed to 49.9% YoY, far below earlier triple-digit growth rates. This suggests the initial surge in AI demand may be losing steam.

Adapting to Market Changes

Major tech players are adapting to these changing conditions. Companies like Amazon and Elon Musk’s ventures are responding to declining AI demand by delaying AI chip orders and slowing data center investments. These actions reflect shifts in consumer behavior and market saturation.

Government vs. Private Sector

Labor market dynamics add complexity. In the U.S., government job growth (785,000 new jobs) has outpaced the private sector.

This raises questions about the sustainability of the labor market recovery and whether government job creation is masking private sector weaknesses. If AI-driven growth slows, the private sector may struggle to maintain employment, especially in tech-heavy areas.

While AI still holds vast potential, Taiwan’s export decline serves as a warning of possible market saturation. Investors need to tread carefully, weighing high-reward opportunities against the realities of slowing demand and market adjustments. Diversification and caution will be key in navigating this uncertain landscape.

Taiwan’s Economic Performance and Future Projections

Despite challenges, Taiwan’s economy remains resilient, driven by ongoing demand for tech products. In August, the composite index of economic indicators hit 39, signaling a booming economy. The Ministry of Economic Affairsexpects export orders to rise between 4.7% and 8.6% YoY in September, driven by AI, high-performance computing, and cloud services.

However, the trade surplus in September fell short of expectations, due to a larger-than-expected pullback in exports and an uptick in imports. The trade balance dropped to $7.1 billion, reflecting uncertainties linked to fluctuating global demand.

Navigating AI’s Future

Taiwan’s recent AI export slump highlights the fragility of tech-driven growth. As AI continues to evolve, businesses and investors must stay agile, ready to adapt to both opportunities and challenges.

The economic implications of this downturn show the need for diversified strategies to reduce over-reliance on any one sector. AI will remain crucial for economic growth, but not without risks and vulnerabilities.